Promotional Features

Südzucker's 2023 Consumer Study: Challenging times call for high transparency

We live in a world that is becoming more interconnected and complex.

Global crises like climate change and conflicts such as the Ukraine war have a profound impact on consumers. This ranges from products availability to the escalation of prices for essential food items and the increase in energy prices. All of these factors lead consumers to question their previous purchasing behaviours more intensively and to become more price sensitive.

However, this does not imply that consumers will only buy cheap, conventional, private label products. Various factors also influence the purchasing decision when choosing the "right" products. In the end, achieving the right price-performance ratio is key. Beyond price, other criteria have significant influence, such as taste, natural qualities, sustainability and regionality.

As a leading manufacturer of sugar and sugar specialties for the food industry, Südzucker remains vigilant regarding present and future consumer demands. In order to identify future trends, Südzucker conducts annual consumer studies. These insights are then used to create new end consumer products and future-oriented ingredient solutions, which subsequently extend to partners in the food and beverage industry.

Challenging times call for high transparency

This year marked the third annual Südzucker consumer survey* which focused on consumer needs and associated purchasing criteria for processed foods and beverages.

Conducted online in March 2023, the study included approximately 5,000 end consumers across five countries, with 1,000 participants from each across five countries – Germany, Belgium, France, Poland, and the UK. The participants were carefully selected to represent a balanced distribution in terms of gender and age, spanning from Generation Z to Baby Boomers.

The study was focused on five food product categories that contain sugar as a key ingredient:

- Sweet biscuits and baked goods

- Chocolates

- Dairy and vegan alternatives

- Soft drinks

- Cereals & cereal bars

Price is not the main purchase criterion

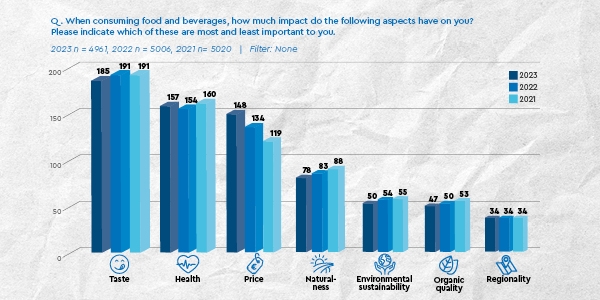

At first glance, the results of the survey show that customers have become significantly more price-sensitive, marking the third consecutive year in which price has been a relevant factor in purchasing decisions.

This trend is not surprising due to the aforementioned circumstances and inflationary pressures. However, it is notable that despite these factors, price maintains its position as the third most critical consideration across all five surveyed countries.

While health has seen a minimal increase in significance, and taste has experienced a slight dip but still retains a considerable level of importance, both continue to overshadow other purchasing criteria by a significant margin.

In 2022 and 2023, given the high inflation rate, it is understandable that criteria such as naturalness, sustainability and organic qualities are losing ground in direct comparison to price. It is worth acknowledging that, although at a comparatively lower level, the importance of regionality has remained consistent over the past three years.

Transparency about ingredients and their origin can make the difference

A more thorough examination of the findings reveals that the topic of regionality has grown as a purchase criterion in some countries, such as Germany and France, where it has gained more relevance.

The importance of the origin of ingredients is also reflected in the fact that 53% of consumers want to have more transparency about ingredients including: ingredient sourcing, production methods, social implications, and environmental impact.

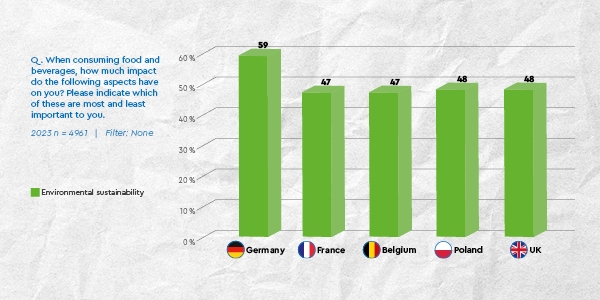

In this context, the issue of sustainability also plays an important role, even if this criterion has lost relevance in direct comparison to price. A deeper look at the data from the survey shows that sustainability is an important criterion for over half (51%) of the consumers surveyed across all categories. There are minimal differences at country level, apart from Germany, where sustainability has a higher priority compared to the other countries. However, it’s important to not dismiss this aspect in other countries, where its relevance as a purchase criterion remains substantial, at just under 50%.

As previously stated, these represent just a selection of the many highlights identified in this year's consumer survey, that are not to be viewed singularly or independent of each other. All these aspects, among others, collectively form a network of complex influencing factors that shape consumers’ choices of products and brands.

Creating added value for the consumer

Südzucker offers valuable partnership opportunities for various objectives such as new product development, market positioning based on factors like regionality, sustainability, and biodiversity, as well as gaining deeper insights for effective communication strategies.

Leverage the partnership with Südzucker to tap into the expertise of marketing and market intelligence specialists, in conjunction with accomplished R&D professionals. This cooperative venture seeks to generate heightened value for your pursuits. Access in-depth insights into diverse consumer requirements through the established marketing department.

Experienced R&D specialists are available to offer application support, aid in reformulating recipes, and develop reduced-sugar alternatives in select product categories. These innovations are tailored to emulate the flavour and consistency of their full-sugar counterparts. The challenge lies in jointly conceiving pioneering products using plant and sugar beet based sweetening solutions.

Through this partnership, the network of Südzucker Group is available, involving more than 260 in-house R&D experts. These specialists span across the Sugar Division and other relevant domains, thereby presenting avenues to leverage synergies throughout the whole group.

To learn more about Südzucker’s analysis of consumer purchasing behaviours, visit Südzucker.com or its LinkedIn page.

*This consumer research has been conducted together with Human8 Consulting