Nizo hints at advancing alternative protein innovation with newly-acquired lactic acid hub

Nizo was founded by the Dutch dairy industry as an essential R&D vehicle for the industry, the organization contributing both with research and new product development know-how over several decades. In more recent times, alongside working to solve food innovation conundrums in the dairy space, the company has been focused on tackling challenges associated with alternative protein innovation.

For example, Nizo has been experimenting with improving the flavor and texture properties in plant-based proteins used in dairy and meat alternatives. The company introduced with the process of bio-purification, where lactic acid bacteria and yeasts are applied to food ingredients in order to remove unwanted molecules in alternative proteins and improve flavor and texture properties; and remains a leading researcher and producer of lactic acid bacteria.

A recently-acquired lactic acid production facility formerly owned by Vika Nutrition B. V. is thought to have further strengthened the company’s position in that space. Vika Nutrition was previously part of Nizo and the former's expertise in producing lactic acid permeate known as Ceska-Lact was described by a Nizo spokesperson as ‘pivotal in our operations’.

In 2017, Vika B. V. was acquired by flavor and flagrance house Givaudan to strengthen the latter’s portfolio of natural dairy solutions. In 2020, the Netherlands-based processed and grated cheese business acquired from Vika was sold as Givaudan opted to focus on its core offering.

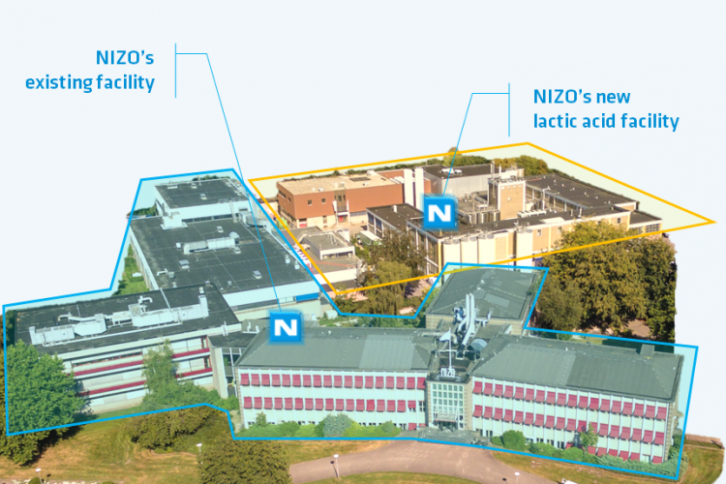

Vika B. V.’s Dutch facility is adjacent to Nizo’s food research headquarters in the northern outskirts of Ede, central Netherlands. “The acquisition came about as Vika Nutrition no longer aligned with Givaudan's strategy post-acquisition by Givaudan,” a Nizo spokesperson told us. “After thorough consideration, Nizo emerged as the ideal candidate to acquire the facility, given our existing relationship with [dsm-firmenich] and the potential for collaboration.”

The acquisition, completed for an undisclosed sum, forms part of a long-term contract manufacturing partnership with dsm-firmenich, the two companies having collaborated for around 30 years so far. The agreement primarily entails Nizo selling its lactic acid product exclusively to dsm-firmenich. Dirk Lippits, dsm-firmenich EVP of Ingredient Solutions, said Nizo’s expertise had already in food and health research and holistic project approach ‘have often boosted our innovation development already’. “This supports our belief that Nizo is the right partner for dsm-firmenich for the supply of lactic acid and for support in future R&D projects,” he added.

But the facility’s acquisition may hold greater significance for Nizo in the long run, and particularly with regards to innovations by means of leveraging bio-purification, which itself relies on lactic acid use. The firm recently completed a €5m ($5.45m) investment program to upgrade its pilot plant for the development and upscaling of plant-based and other alternative proteins and is offering opportunities for start-ups and scale-ups within this domain as well as public and private partners to further develop the Nizo Food Innovation Campus. The acquisition of the adjacent site opens the door to further developing these initiatives, the company said.

Responding to a DairyReporter enquiry regarding what opportunities the facility brings in terms of progressing alternative protein innovation, we were told the following: “Regarding the bio-purification process of plant-based ingredients, we are currently exploring the potential developments that the newly-acquired facility could bring. At this stage, specifics are still being evaluated, and we look forward to sharing more information as plans progress.

“We foresee continued growth and demand for lactic acid products. While our immediate focus lies in selling the lactic acid product, Nizo remains committed to optimizing production processes and supporting further innovation in this area.”

Lactic acid has applications in the food industry but also in the pharmaceutical and chemical industries as well as in feed and cosmetics. A 2013 review of the properties and applications of lactic acid concluded that around 70% of the organic acid is used in the food industry, specifically in the production of yogurt and cheese. Meanwhile, the bacteria that produces it is often found in a variety of fermented foods, including dairy. Lactic acid bacteria is one of the most commonly used probiotics, another thriving market which boomed during the pandemic and remaining on a steady double-digit growth trajectory; Lumina Intelligence reported that growth remained strong both in 2021 (21%) and 2022 (18%). According to a 2023 Circana review of the US probiotics market, consumers want an easier way to ingest probiotics, and turn to the ingredients as a solution to a raft of health and wellness issues, particularly gut health, which leads category sales.

Fermented dairy is also experiencing a momentum, with Future Market Insights estimating the global segment will grow at a CAGR of 8.5% from 2022 to 2032 and more than double in value terms, from $4.9bn in 2022 to 11.2bn in 2032. Meanwhile, the dairy alternatives market is also widely tipped for growth, but innovation in nutrition, functionality and taste will be crucial to advance the segment's development.