Arla, Kraft Heinz, Unilever grilled by UK parliamentary committee over ‘greedflation, profiteering’

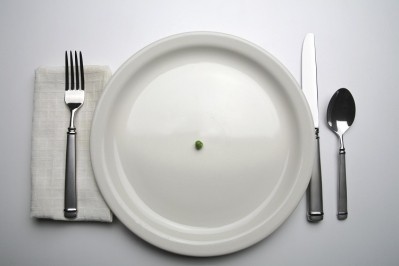

In a meeting that spanned more than two hours, members of the Environment, Food and Rural Affairs Committee questioned executives from Arla Foods, Kraft Heinz and Unilever about deploying the practice of ‘shrinkflation’, their relationships with retailers and their approach to foods high in fat, salt and sugar (HFSS).

Representatives from Dairy UK, the Agricultural Industries Confederation and the Provision Trade Federation were also questioned on issues regarding the impact on inflation on suppliers’ and manufacturers’ costs and how production costs, food prices and retail prices interact.

Peter Dawson, policy and sustainability director at Dairy UK, explained how manufacturers and processors had altered their practices as a result of the recent high rates of food inflation, stating that ‘there may have been some simplification of product lines’. “I think there may have been change in some product mix because consumers are obviously more focused on value during high food price inflation. There may have been some simplification of product lines, but I would imagine that hopefully now consumer confidence has picked up a bit, that we still are able to revert back to the full spectrum of product offering we had before.”

He added that when it comes to the supply chain relationships with dairy farmers and the margin pressures suppliers face, the fundamentals ‘remain unchanged, unfortunately’. “The dairy industry now is exposed to a global pricing dynamic. The global supply-demand balance for raw milk has manifested in the commodity markets, which drives raw milk prices; it provides the underlying trend, and that's true of all industries exposed to the world market.”

Dawson added that only a small segment of liquid milk providers are shielded from the global pricing dynamic. “There is a segment of the UK dairy industry, which is to a degree isolated from these trends,” he explained. “This is those dairy farmers under a line supply chain arrangements with their retailers; those arrangements determine the price paid to farmers. And for many retailers, that’s based on cost of production, but those arrangements only cover about 20% of milk volume in the UK.

“The rest of milk supply is subject to this global pricing dynamic, which does ultimately embrace the liquid milk market as well, because if market prices are rising, the returns from liquid milk also have to be competitive. So that is the mechanism by which liquid milk is ultimately linked back to commodity markets.”

Asked if dairy processors had been too quick to lower farmgate milk prices on the back of inflationary pressures but then slow to increase them again once inflation had eased, Dawson said: “No, I don’t think it is [fair criticism]. I think our members, the dairy processors, are feeling the impact of food price deflation quite severely. Their prices came under immediate pressure once the commodity market started to fall back, and certainly, the cheese sector, has suffered quite badly because they’re purchasing more milk at a high price and then selling the resulting product which had been matured onto a declining market.”

Turning to the relationship between producers, processors and manufacturers, the committee heard that while the global marketplace dictates the price processors pay farmers, retail prices are very much at the discretion of the retailer.

Asked if consumers could expect to see lower dairy product prices that correspond to the falls in global commodity prices, Dawson said that at retail level, price reductions would possibly ‘percolate through to the consumer’ if there was enough competition between retailers. Robert Sheasby, chief executive of the Agricultural Industries Confederation, added that the best indication of how retail prices are ultimately affected by changes in input costs would be to examine Competition and Markets Authority data. “They have been looking into various sectors,” Sheasby said. “I didn't find that there was a problem with liquid milk – [the CMA] came to the conclusion that it was a low-margin sector, but they have only highlighted infant formulas as worthy of further investigation.”

Asked how he could be confident going forward that as dairy prices come down, the farmers “aren't plunged, if they're not already, back into producing milk less than the cost of their cost of production”, Arla Foods UK MD Bas Padberg said: “We have organized ourselves as a big dairy cooperative where we can actually spread our risks and businesses around different parts in the world. We are investing here in the UK and in state-of-the-art factory [in Devon, ed.] that would allow us to sell great products here in the UK, but also outside of the UK, so that we have options to manage to get the best possible price for our farmers, so playing at those different levels would allow us to better deal with that situation.”

‘I’d like you to reply now’

In the second half of the hearing, the tone intensified as committee member and Labour MP Barry Gardiner questioned the witnesses. Gardiner said that the profits of eight of the top 10 food manufacturers combined were £23bn in 2021 on 2019; how was that possible? Turning to Kraft Heinz’s UK head of supply chain Dominic Hawkins, Gardiner asked: “If all you were doing was passing on the input costs, the increased cost of your supply chain, then [the public] expect your profits to stay roughly the same.

“But Mr Hawkins, if I look at the report from IPPR that looked at your company during the period, it saw your profits rise from £265 million to £1.8 billion. How do you justify that to the family that is struggling?”

Hawkins said that due to the company’s corporate setup of having different entities in different regions and locales, they would prefer to respond in writing. “I’d like you to reply now,” Gardiner said. “You knew what you were coming here for; you knew that we were concerned about greedflation, profiteering; you knew that was what you were going to be drilled on, so please, give me the answer now, not in some letter later on when it's not in the public eye.”

“What's important to say is firstly we've always passed on less than the input inflation,” Hawkins responded. “If I give you some examples of that and we look at some specifics around the inflation we've seen in our input costs, in the years from 2021 to 2023, we've seen a 16% increase in the cost of our beans, a 101% increase in the cost of our tomatoes, and we've seen around a 50% increase in the cost of tin plate which we use to manufacture our tins. So I can assure the committee on is on a percentage basis, we've put through less cost price increases than we've seen as our input inflation.”

As for how the company achieved the profits it did, Hawkins said that “there are lots of other factors that make up an EBITDA or a bottom-line profit”, such as one-off costs. “We do have things like efficiency programs but the bigger impact tends to be things like one-offs on an annualized basis. If you're comparing profit from one period to another, and certainly if you're looking after profit after tax in a publicly-listed company or a limited company…, there are lots of one-off variables that can affect that. That won't necessarily mean you're comparing like with like on a year-to-year basis,” he added.

The questioning turned to Marc Woodward, UK and Ireland head of Unilever. “You've reported a rise in pre-tax profit of 21% for the first half of 2023 but your company's claimed that it has not been profiteering in any form from rising prices,” Gardiner said. “So perhaps you could tell me how you have tried to protect the consumer?”

Woodward said that Unilever had passed down pricing ‘as a last resort’: “It's certainly not the first place that we would go we look within our own organizations to save costs. We are acutely aware of how sensitive price is at the moment. You simply cannot run a successful organization in this market by pushing forward prices that are not justified so we always look at other ways before we go to market with cost price increases on after a period of stability.”

The Labour MP proceeded to press Woodward on Unilever’s ‘huge’ net margins, but the committee member erroneously referred to net income to stockholder margins, which had gone up from 10.8% in 2019 to 12.7% in 2022. “I'm not familiar with the numbers that you're coming up with,” Woodward responded, “but I do have published accounts for the UK, [and] we've got very static turnover since 2017 in this market, about £1.8bn. Our operating margin, which I think is the [one] to which you are referring, is actually relatively static, at around 4.5% and 6% in the UK last year.”

Saucy exchanges continued on ‘shrinkflation’

Turning to ‘shrinkflation’, where manufacturers downsize products but keep prices the same or higher, Kraft Heinz’s Dominic Hawkins said the company hadn’t engaged in the practice, but was asked why Kraft had decreased the volume of beans in its 415g tin from 51% to 50%. “That wasn’t a deliberate reduction and it’s well within a normal tolerance,” he said. “We didn't deliberately reduce the number of beans in the tin - we did reformulate based on what our consumers wanted. There wasn't a cost or like efficiency saving driven by the number of beans in the can. We did change our recipe to make it taste better,” adding that more tomato and other ingredients had been added. But the committee countered: what cost more, the beans or the tomato sauce? “It depends which component of the sauce,” he said adding that the information is commercially sensitive.

The committee then enquired about Arla’s decision to shrink the size of its premium butter and spreadable, but the company’s executive responded that the firm had also lowered the recommended prices. Padberg said the pack size change was “purely an adjustment of what we call the out-of-pocket price – so what consumers actually pay for a pack; it's really trying to serve consumers that are tightening their belts, basically”.

Labour MP Cat Smith turned to labelling. “Some shoppers are super savvy, and [others] are really rushed off their feet and busy; they haven't got time to look at how many grams of mayonnaise there is in a jar or how many grams of cereal there is in a box,” she said. “It's in the small print on the label on the shelf; but…when there's been a change in the size of the packaging, should that be a larger print so that the consumer…can see that that jar of mayonnaise or any other product…has shrunk? Should that be more explicit?”

Kraft Heinz’s Hawkins said that consumer do look at shelf tickets; if that changes, then consumers notice. “Should that be in bigger writing? I think that's [down to the supermarket].”

Smith pressed on: “A lot of people are very explicit when they increase the size of something - like ‘20% extra free’ – but when there's 20% taken out, that's not really explicit on the box isn't it?” Hawkins reinforced his earlier point, stating that this is a retailer rather than a manufacturer concern.

The committee is set to question retailers at a later stage, though no date has yet been set up. The entire meeting is available to view via parliament.tv.