‘Risk averse’ food industry slow to take up AI and digital

Tight margins, a lack of essential skills and slumping capital are causing many food and drink manufacturing businesses to remain “risk averse” when it comes to innovation.

Despite the food industry being the UK’s largest manufacturing sector, with around 12,000 businesses, it lacks government mechanisms and investment to properly support technology innovation and implementation, causing challenges for SMEs in particular, according to the Policy Exchange’s Strengthening the UK’s Food Security report.

Join us for the free Climate Smart Food digital summit

“Although elements of the sector are cutting edge with global food and drink manufacturers leading the way, there is considerable variation across the industry,” it said, adding 40% of food industry stakeholders did not use any sophisticated digital technologies at all.

“Only 33% reported using digital technologies in manufacturing processes, quality control and oversight, indicating a much lower implementation rate than one might expect,” the report added.

How are food and drink makers using AI

Most food industry stakeholders can’t acquire “fit for purpose” technology, while others cite high investment, complexity and a lack of inhouse skills as other reasons to not adopt AI and other tech.

“This particularly affects SMEs, which make up most of the food and drinks sector and leads to concerns that there could be entrenchment of a two-tier evolution of technology innovation with large, often multinational players leading the way and SMEs lagging behind,” it added.

Already pressured by rising staffing, ingredient, fuel and other cost hikes, additional hurdles food manufacturers have to overcome in new tech adoption will likely make them wary of investment or put them off altogether

They may invest in areas like established data capture, optimisation and some automation solutions, “however they are not ready for novel and untested innovations and methodologies”, added the report.

More investment needed in F&B AI tools

There was a need therefore for support around established technologies and their adoption, not innovation around lesser known and novel tech, some manufacturers argue. As a result, manufacturers want to see more investment in automation.

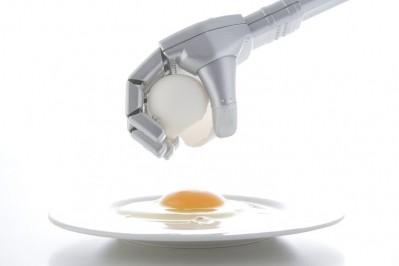

“One global food manufacturing company interviewed explained ‘more needs to be done on automation. Sensor technology is the biggest increase to automation currently and robotics. Data and AI have potential in supply chain management and forecasting… spotting disruption before it happens to predict demand changes etc. with big data analysis’,” said the report.

AI as a solution is of interest to the sector and manufacturers understand its potential to increase productivity, but it has not yet been absorbed by the majority into daily business practices.

“At the moment people are making the connections of data on how to run the line etc. AI could be making these connections. The UK is the perfect spot for these expansions,” said a global manufacturer.

Other companies utilising AI are exploring its use in early warning systems by using sensors to help estimate and prevent potential breakdowns. Though smaller food manufacturers are less clear about its potential and see little application for AI’s use in their businesses.